The economy It is one of the most important areas of people's daily lives. From the way we spend money to the political decisions that affect our communities, the economy influences every aspect of our lives.

However, it is often a complicated topic for many. Understanding how economic systems, government policies, and markets work, and how they affect personal finances, is essential for making informed decisions.

Economic education is not only necessary for financial professionals, but also for the general public, who must know how to manage their money, make smart investments, and understand the impact of the global economy on their lives.

Today, having an accessible tool for learning about economics is easier than ever thanks to technology. Mobile apps offer a convenient way to gain knowledge and tools to manage our personal finances and make sound financial decisions.

These apps provide everything from definitions of financial terms to more complex resources, such as investment simulators. In addition, many apps are updated in real time to keep up with the latest economic news. In this context, some apps, such as Investopedia, excel at providing quality financial education, enabling users to understand and navigate the complex world of economics and finance more easily.

What is the Economy and why is it important?

The economy is the study of how societies allocate their scarce resources to satisfy unlimited human needs. At the global level, the economy can be viewed as an interconnected system involving the production, distribution, and consumption of goods and services. To understand the economy, it is necessary to know various aspects such as macroeconomics (which studies global phenomena such as inflation, unemployment and economic growth) and microeconomics (which focuses on the individual decisions of consumers and companies).

In a globalized economic environment, people are constantly affected by economic policies, financial markets, and government decisions. Understanding how these elements interact and how they can affect our personal finances is crucial. This is where educational tools, such as specialized mobile apps, play a fundamental role.

Features of an Educational App to Improve Your Financial Knowledge

There are applications designed to provide users with access to a wealth of information related to finance and economics. These applications aim to make complex financial concepts accessible and understandable to everyone, from novices to experts. Through these tools, users can receive clear and concise explanations on a wide variety of economic topics, allowing them to make more informed decisions.

Below are some of the key features these educational apps should have to improve financial literacy:

1. Clear and precise definitions

One of the most notable features of the best educational apps is their extensive glossary, which provides comprehensive and easy-to-understand definitions of financial and economic terms. This feature is especially useful for those just starting to learn about economics or who don't have a deep understanding of the subject. Definitions should be clear and explained in an accessible way, helping users understand even the most complex concepts.

2. Educational articles and tutorials

These apps offer a wealth of educational articles and tutorials covering topics such as investing, financial markets, the global economy, taxes, and more. The resources are designed to educate users in a practical, real-life way. Throughout the articles, real-life examples are used to facilitate understanding and provide more effective learning.

3. Investment simulators

One of the most useful features of these apps is their investment simulator, which allows users to practice and learn about the stock market without risking their money. The simulators provide real-time scenarios that reflect market movements, allowing users to learn how to make informed decisions in a simulated environment. This feature is ideal for those who want to understand the financial market without the consequences of losing real capital.

4. Financial calculators

Financial calculators are another key feature in these apps. They allow users to perform calculations related to mortgages, loans, taxes, pensions, and other aspects of their personal finances. These tools are useful for making informed financial decisions and evaluating different scenarios before committing to a major financial action.

5. Real-time economic news and analysis

The app should also offer news and expert analysis on global economic and financial events. Users can access real-time updates on the state of the stock markets, monetary policies, economic changes, and much more. This helps users stay informed and prepared to make decisions based on current events in the financial world.

6. Extended Financial Glossary

The financial glossary of the best educational apps covers a wide range of terms related to finance, economics, and business. It's a very useful tool for those looking to quickly clarify doubts about specific terms or who want to delve deeper into technical concepts without having to consult multiple sources.

Benefits of Using an App to Manage Your Finances

Using educational apps on economics and finance offers multiple benefits that can transform the way users understand and manage their personal finances and economic knowledge. The main benefits include:

– Easy access to financial education: The apps make learning about economics and finance accessible to everyone. Regardless of prior knowledge level, the app is designed to be understandable, even for those just beginning to explore these topics.

– Practical learningInteractive tools like investment simulators allow users to learn in a practical and realistic way, helping them acquire skills they can directly apply to their financial lives.

– Continuous updatesIn a constantly changing economic world, staying well-informed is key. Apps should provide up-to-date news and analysis, allowing users to stay abreast of economic changes and make informed decisions.

– Easy-to-use interfaceThe application should be designed with an intuitive interface, making it easy to navigate between the various sections and access educational resources quickly and easily.

– Promoting financial autonomyThrough the knowledge gained from these applications, users can make more informed decisions about their investments, savings, and other important financial aspects, thus promoting greater financial independence.

See also:

- Healthy Fashionista Snacks: Balanced Nutrition, Stylish Presentation, and On-the-Go Convenience

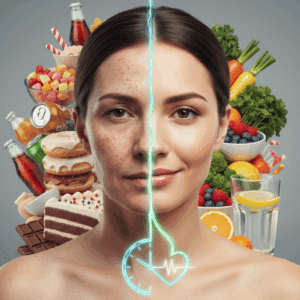

- How Reducing Sugar Intake Improves Skin Health, Prevents Aging, and Boosts Overall Well-Being

- Anti-Inflammatory Diet: Key Foods, Nutritional Benefits, and Impact on Health and Aging

- Health Benefits of Clean Eating Versus Processed Foods and Practical Dietary Strategies for Wellness

- Adapting Fashion to Body Changes and Ethical Values for Diet-Driven Style and Confidence

Conclusion

In conclusion, the economy Economics is a fundamental discipline for understanding the world we live in, and educational apps like Coursera play a crucial role by providing the tools and resources needed to learn and make informed decisions. This app is not only useful for those interested in improving their understanding of markets and finance, but also for those looking to improve their personal financial well-being. With its diverse features, from simple definitions to investment simulators, Coursera has become an indispensable tool for anyone who wants to learn more about economics and how it influences their daily lives.

Coursera It is undoubtedly an application that can make a significant difference in the way people understand and manage their personal finances, offering easy access to high-quality educational resources.